In particular it will not turn, say 7 returns into 21 returns for the long term. Then the ETF would lose its raison detre. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The Fund will, under most circumstances, consist of all of stocks in the Index. Ultimately the leverage would approach 1x (unleveraged) for a 'successful' long ETF or 0x (cash-like) for a 'successful' short ETF. Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index ®.

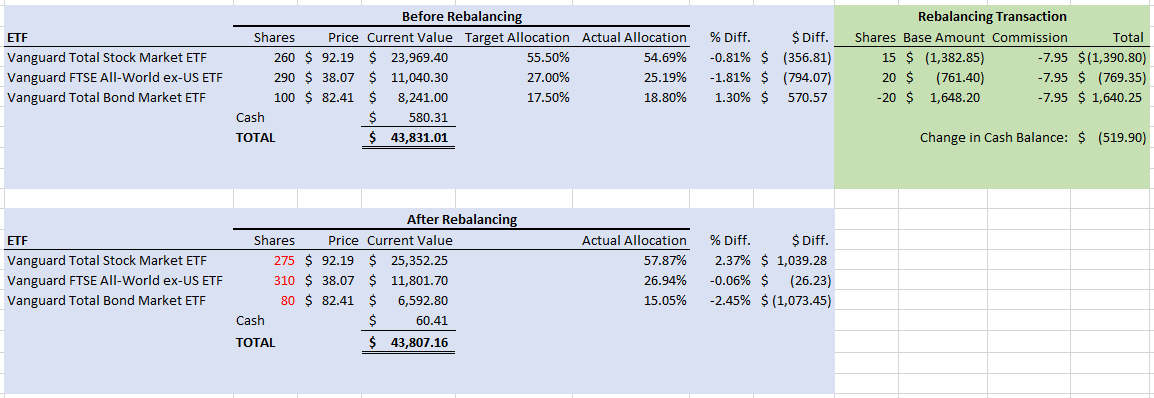

#DIA ETF REBALANCE FULL#

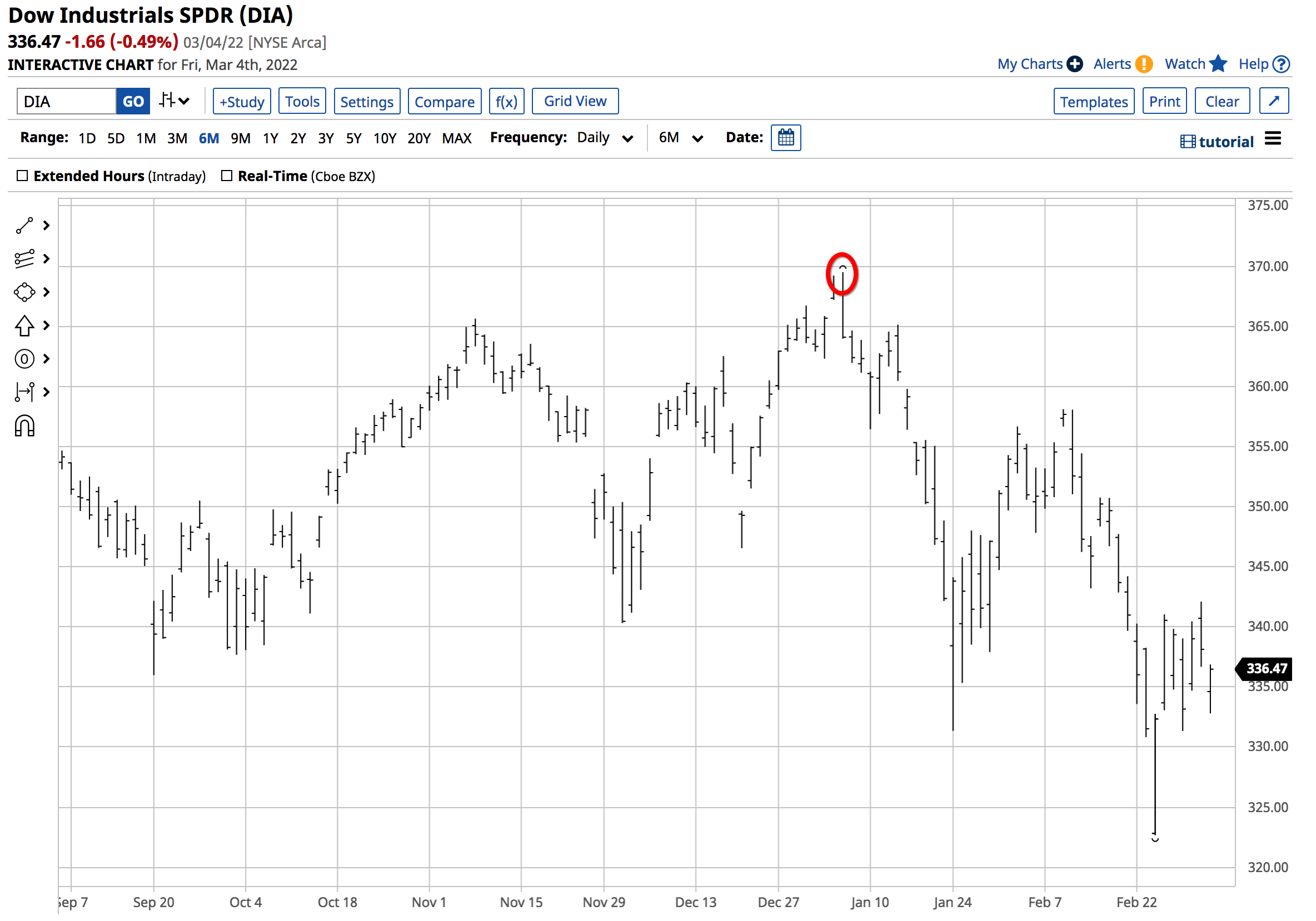

Full parameters include the entire 9, 15, or 30 buffer as well as the full upside cap. If the ETF appreciates greatly, then without rebalancing, its leverage will decrease. View the latest ETF prices and news for better ETF investing. “It’s the biggest rebalancing since 2020 in terms of buying equities,” JPMorgan strategist Nikolaos Panigirtzoglou told Bloomberg, adding that inflows of at least $100 billion and as much as $230 billion could contribute to gains of between 5% and 10% to global stocks. By purchasing the ETF prior to the rebalance ensures that an investor receives the full parameters of the upcoming new outcome period. DIA - SPDR Dow Jones Industrial Average ETF Trust NYSEArca - Nasdaq Real Time Price. DIA A complete SPDR Dow Jones Industrial Average ETF Trust exchange traded fund overview by MarketWatch. As the first quarter draws to a close, institutional funds could fuel a technical boost to global markets. Ann: S&P DJI Announces September 2020 Quarterly Rebalance. The ETFs/Stocks utilized for this strategy are categorified into two distinct groups: bullish. Learn everything you need to know about Global X Dow 30 Covered Call ETF (DJIA) and how it.

The stocks included are rebalanced periodically, reflecting the dynamics. These money managers typically rebalance market exposures every quarter to keep in line with strict allocation limits between stocks and bonds. Market Signal Based Asset Allocation & Rebalance. this paper to index mutual funds and exchange traded funds (ETFs), have the. projects that institutional investors could contribute to a potential $230 billion equity-buying spree as valuations look much cheaper, bolstering beleaguered global equity markets by as much as 10%, Bloomberg reports. Meanwhile, the Vanguard Total International Stock ETF (NASDAQ: VXUS) fell 11.5% and the iShares Core MSCI Total International Stock ETF (IXUS) dropped 11.8% so far this year.

0 kommentar(er)

0 kommentar(er)